Your Pitch Deck Sucks!

Steal My 9 Slide Framework To Become The One

In 1,000 They Email And Say… “Let’s Set Up A Call!”

The One In 1,000 They Email And Say…

“Let’s Set Up A Call!”

Let me say hi

Don’t take my word for it

Result: went on to raise $630K

I can’t speak highly enough of Ed’s startup advisory services and the assistance he provided with our pitch deck. His detailed feedback was incredibly insightful, transforming our deck into a polished and compelling presentation. His expertise and attention to detail made all the difference in helping us secure seed funding. I highly recommend Ed’s services to anyone looking to elevate their presentations and raise capital.

Ed’s knowledge and experience have been invaluable in creating a solid path forward for my business. I would HIGHLY recommend him to anyone looking for business consulting or fundraising advice. After collaborating with him, I wouldn’t work with anyone else!

I was introduced to Edward through a mutual friend who spoke very highly of him, and I can honestly say that even with the high bar set, Edward blew me away with the amount of insightful information he provided. He has years of experience pitching investors, and it comes through in his knowledge of what they’re looking for, what to highlight and eliminate, fundraising strategy, and financial structuring. His feedback was invaluable, and we rearranged our deck with almost every one of his suggestions. The flow was so much more fluid, and investors noticed. He really is an expert in this field and brings immense value to his clients! Highly recommend him as an asset to any team.

We fumbled around with our pitch deck for months. Ed’s guidance was instrumental in getting us meetings with quality investors. Can’t recommend enough!

Ed is incredibly efficient in providing valuable advice for investor materials. He quickly grasped our business model, our target market, and strategy. He was able to give pointed feedback on our investor deck which I was able to implement right away and notice an instant uptick in investor engagement and conversion to next steps. Ed knows exactly how pitch decks should be structured, the questions they should answer, and how to boil down complex concepts into concise messages that the reader can absorb at a quick glance. One impression and often less than 30 seconds is all you have. I would definitely hire Ed again.

Ed collaborated with our agency to enhance our presentation and process. I appreciated his recommendations and improvement plan, which helped position our organization’s USPs in a compelling way. Our audience quickly understood our value proposition and why we are differentiated within our industry.

Ed’s feedback was on point. He quickly understood my business. The video delivery format was concise and digestible.

Ed did a great job with our deck. He took an unbiased view and was very straight forward with his feedback. His suggestions were simple to implement yet very effective to the overall improvement of the deck. Whether you are a first-time founder or a serial entrepreneur… having Ed’s opinion is a great tool!”

Ed’s video review exceeded my expectations. One insight in particular was huge for our cap raise. His experience as a founder and raising capital clearly shows. I would recommend Ed in particular if your start up is in FinTech or SaaS.

Ed’s video review of my pitch deck was very insightful, and I think it will go a long way as I start pitching more potential investors. He changed up the order of the presentation in order to tell a more cohesive, convincing story. He removed slides that weren’t adding enough value to the presentation and provided detailed suggestions for different slides I should create in their place. I agree with almost everything he said, but I needed a trained second set of eyes as I wouldn’t have come to these conclusions myself. I’m much more confident in my deck and I’m excited to start pitching.

Result: went on to raise $2M

The speed at which Ed generated interest in our raise and closed on funding was nothing short of amazing. He was a critical part of our convertible note round from deck creation and granular modeling work through to investor pitching and closing tickets. Easiest money I’ve ever raised. Ed was an investment well made.

Edward’s experience and knowledge of pitch structure and design is world class, and his decade of experience in high finance clearly shows. He’s also a great human being who was a blast to create with and brought really solid creative thoughts to the conversation about how to design our deck. Five stars. Hire him!

Ed is an incredibly valuable resource for our founders. He productively challenges how they think about the most critical aspects of their businesses. It was a no brainer to bring him on regularly. Highly recommend!

Ed quickly identified some of the pitfalls of sending our deck to investors in its current state and let us know how we could improve our messaging. I could tell that he took the time to understand what we were doing and how we could make our business more appealing to investors, and he made sure that investors could get an understanding of our business at a quick glance. I would definitely recommend him, he knows what he’s doing, and if you’re thinking about having someone help you put together a good pitch deck, I think Ed’s the guy.

Ed’s video review of my deck was incredibly valuable. He was direct, thoughtful, and provided immediately actionable feedback on how to improve the deck. He also asked the tough questions I needed to hear, and hearing them from Ed before pitching investors is a huge value prop for me.

Ed built a great deck and was a pleasure to work with. He has a strong ability to cut through the noise and isolate the most important messages in the presentation. Super happy with the result.

The video review was straight to the point, no BS, only valuable feedback. I suggest getting one from Ed if you need guidance on how to improve your investor deck with limited time. High energy guy. Recommend.

I spent six months building a local online marketplace, much like Fresha, but aimed at a different industry. Then I met Eddy, and he video-roasted my deck. He was the first to spot that Fresha connection. Since then, at least two people a week make the same connection!! Kinda funny how I never saw it myself until Eddy lit the bulb in my head. He even pointed out that my startup avoids the usual route where private equity gobbles up local services in bulk— something I hadn’t known. I didn’t agree with all his critiques, but most of them definitely rang true and helped me sharpen the concept before launching my MVP. His insight mattered. Recommend a video roast!

Ed’s video review of my pitch deck was absolutely phenomenal! I was completely blown away by how precise, insightful, and to the point it was. Every single sentence in his feedback was like gold—clear, actionable, and exactly what I needed to hear. His review gave me a fresh perspective on how investors think, helping me refine my pitch in ways I hadn’t considered before.

For first-time founders like me, this kind of feedback is invaluable. We often struggle with what to include in a pitch deck, even when we have a great business and idea. But if we can’t communicate it effectively, it’s a missed opportunity. Ed’s insights bridge that gap perfectly.

If you’re working on your pitch deck, I highly recommend getting a review from Ed. It’s a game-changer!

Ed’s video review was super valuable. Agreed with pretty much everything he said, but needed to hear it from him instead of from an investor. Our deck was immediately better off, especially for cold audiences.

In the startup world, particularly during fundraising, feedback and guidance are critical. Edward’s insight and interactions have been invaluable to my clients. He quickly distills challenges within pitch decks and offers recommendations to bring clarity to founders. His ideas not only improved pitches, but they were also productive for the business models themselves. Along this hectic founder journey, a partner like Edward is a must.

Ed provided a huge amount of value in such a short period of time. My deck resonated with investors so much more after I incorporated his feedback. Working with him was an absolute no brainer.

Ed’s experience as a SaaS founder was directly relevant to my business. I was impressed by how much actionable feedback he was able to give so quickly.

Edward built out a detailed, multi-year revenue projection model for our business, and it played a crucial role in securing the investment we needed. Edward’s work was precise, insightful, and gave us the confidence to present a strong financial plan to potential investors. He took the time to thoroughly understand our business and goals, ensuring that the projections were not only accurate but also aligned with our long-term vision. Edward’s ability to communicate complex financial data in a clear and concise manner made the entire process smooth. We are extremely satisfied with the results and highly recommend Edward for anyone needing top-notch consulting.

Edward is an amazing professional. The amount of value I received during a short interaction was unbelievable. If you are looking for a fundraising expert, look no more, Edward will make things happen.

Working with Ed was very helpful. He provided valuable feedback that helped narrowed down the use case for our product, which was particularly helpful to me as a first-time founder. He is honest and will help you work through gaps in your business and thinking. Highly recommend!

Ed’s video feedback was thoughtful and to-the-point. He gave me actionable changes that I could make immediately to improve the quality of my deck. Great delivery format.

Ed’s video review was very helpful. He identified important things I needed to improve in my deck which many others didn’t see. His recommendations were clear, and he gave tons of feedback I could implement right away. Also challenged some of my thinking. Highly recommend.

Ed’s video feedback was incredibly useful. His insights were spot on, and he saved me from facing some unnecessary challenges from investors. Great value.

Ed gave super specific and actionable feedback. After making the changes we immediately started getting more positive feedback from the investors we are talking to. It’s great getting an external opinion because it can be hard to figure out how a first time viewer is reacting to the info in your deck & what messaging is not landing.

Ed took the time to understand our business and distilled its complexity into a tight presentation. He clearly has the ability to craft compelling but to-the-point narratives that resonate. Highly recommend!

Ed presented some hard questions we needed to hear in his video review. A lot of value, and will have a pretty big impact on our deck. Highly recommend getting an outside perspective.

This came in so handy, everyone loves our pitch deck but what we really wanted is an outsider to tell us their honest opinion. Edward nailed it so honestly. I thought he would come back with a bunch of negative comments to make me redo my deck, but in fact he gave it an 8 out of 10 rating, but with solid to-the-point adjustments, that made it PERFECT! I really appreciated the honesty, expertise, and to-the-point comments.

Over 200 people have given me feedback on my deck. Ed’s video review was by far the best. It was packed full of insightful and easy-to-implement changes.

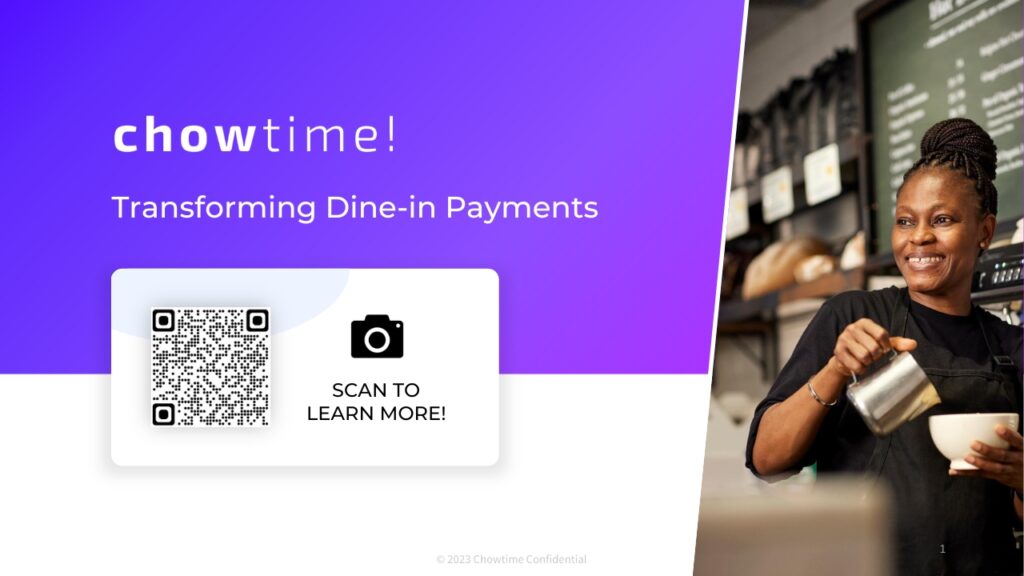

Check out the deck I used to raise for my last business

You are a good fit for me if:

- You’re raising capital for your own venture

- You’re raising capital to buy a business

- You’re selling a cash-flowing business

- You don’t have time to put together compelling materials for your business

- You're struggling to craft a compelling narrative for investors or buyers

- You don’t know what investors or buyers want to see in your business

- You’re struggling to isolate the key needle-movers that drive value in your business

- The fundraising or sale process is overwhelming, makes you nervous, and you don't know where to start

- You're willing to reassess or even re-write your existing materials

You are not a good fit for me if:

- You're building a hyper-specialized business. This is subjective, but I generally avoid things like crypto, deep tech, highly engineered products, energy, etc. (traditional SaaS and tech-enabled services are okay)

- You haven’t tried to validate your business. This doesn’t necessarily mean revenue, but does mean you have some indication of demand from your market. Revenue-generating is preferred, cash-flowing even better.

- Your business is not your full-time gig

- You're starting a technology business without a software engineer on the founding team (i.e. you're outsourcing development)

- You aren't willing to listen to outside feedback that may challenge how you present your business

Done-with-you

Deep Dive Business Assessment

$4,549

What you get

- Brutally honest assessment of your business

- The feedback your friends are afraid to give you

- Pitch outline and narrative construction

- Key questions to expect from investors or buyers

- Challenges your business may face from investors or buyers

- 1 mock pitch practice session

Best for

- Founders with traction struggling to craft a narrative

- Acquisition entrepreneurs and business owners struggling to position their deal

- You’re worried about what you don’t know

- You need practice pitching your business

Turnaround

About 1 week

100% Money Back Guarantee

If you’re not satisfied with the value I’ve delivered, just say so, and I’ll give you your money back. Full stop.

Done-for-you

Full stack materials build out

$350 /hour

What you get

- Everything in “Done-with-you”

- Full deck build out

- Cash flow projection model (if required)

- Dataroom prep (if required)

- Unlimited follow up calls

Best for

- You lack the time or expertise to build a compelling deck, model your business, or prepare a dataroom

Turnaround

~1-3 weeks

100% Money Back Guarantee

If you’re not satisfied with the value I’ve delivered, just say so, and I’ll give you your money back. Full stop.

Fundraising / M&A

Success-based deal promotion

$5,000 + success fee

+ success fee

What you get

- Your deal promoted to my network of hundreds of investors

- Targeted pitch deck feedback (if required)

- Unlimited consultations / follow up calls

- Regular process updates

Best for

- Founders with traction

- Business owners with cash flow

- You need to expand your pool of potential investors or buyers

Turnaround

Varies by deal

End-to-end deal

execution wingman

$13,950

per month

+ success fee

What you get

- Everything in “done-for-you” and “success-based deal promotion”

- Long term (multi-month) fundraising or sell-side support

- Support from pitch and model creation through negotiations, closing, and funding

Best for

- Looking for dedicated support on a fractional basis

I don’t have any hard and fast rules, but here are some general guidelines I follow:

- I am unlikely to be helpful if you are starting a technology business without a software engineer on the founding team (i.e. outsourcing development).

- I am unlikely to be helpful if you haven’t tried to validate your business. This doesn’t necessarily mean revenue, but some indication of demand from your market. Revenue-generating is preferred, cash-flowing even better.

- The business should be your full-time gig.

- No hyper-specialized businesses. This is subjective, but I generally avoid things like crypto, deep tech, highly engineered products, energy, etc. (traditional SaaS and tech-enabled services are okay)

- I skew towards traditional businesses.

I do not invest in deals at this time, this is strictly a fundraising and sell-side M&A consulting business. I would like to start investing personal capital into deals at some point, but I’m not there yet.

Reach out via the contact form at the bottom of this page with a brief description of what you’re working on and what you’re looking for. Please attach your latest deck and any other relevant materials.

Your message will be sent straight to my personal inbox, and I’ll reply with a few times to set up a brief 30 minute intro call.

I can get to know you and your business on the call, and if it’s a good fit, we can get started based on the level of service you need.

I’m keenly aware of the impact a breach of confidentiality can have on your business and my reputation, and I take confidentiality seriously.

I will never share confidential information about your business without your express permission. I’m happy to sign an NDA.

This varies depending on the level of service you need, the state of your existing materials, and the complexity of your business.

Deep dive business assessments usually require very little of my clients’ time if they have existing materials I can review, while more involved pitch creation and modelling exercises may require a number of Q&A iterations via email or video call for me to more deeply understand your business.

I’m happy to communicate via email, text, or video call. For video calls, I usually use Google Meet, but I’m happy to use Zoom or Teams as well.

All presentations and modelling exercises are done in PowerPoint and Excel, respectively (not Google Slides and Google Sheets).

I manage projects in Notion and use Google Drive, WeTransfer or email for file sharing.

I use Toggl to track hours.

Yes, for the right deal.

Tell me a bit about your business via the contact form below, and we can discuss if your deal is a good fit.

My success fee starts at 7% and declines with the amount of capital raised using a simple waterfall structure. This applies to both fundraising and the value of sell-side M&A transactions:

- 7% up to $500,000

- 5% on the next $500,000

- 3% on everything above $1,000,000

For example, a $5 million EV transaction or capital raise would generate a success fee of $180,000.

- 7% x 500K = $35K +

- 5% x 500K = $25K +

- 3% x 4M = $120K

- 35K + 25K + 120K = $180K

WITH ME

Messages go straight to my personal inbox. Send me a brief note about what you’re working on, and I’ll reply with some times that work for a call.

Don’t forget to attach your deck as a PDF.

Subscribe to my newsletter

I don’t write that often, but when I do it’s fire 🔥